From Core Systems to Copiers: Why IT Asset Visibility Is a Bank’s First Line of Defense

The Cyber Risk Most Banks Don’t See Until It’s Too Late

The Cyber Risk Most Banks Don’t See Until It’s Too Late

When banks think about cybersecurity risk, attention naturally gravitates toward core banking platforms, online banking systems, and customer-facing applications. These systems are critical, but they’re not where many incidents begin.

In reality, some of the most damaging security failures start with assets that never make it onto a formal inventory: printers, copiers, legacy servers, decommissioned hardware, or devices quietly inherited through mergers and acquisitions.

For U.S. financial institutions operating under increasing regulatory scrutiny, asset visibility has become a frontline defense, not a back-office function.

The Asset Visibility Crisis in Financial Services

The scale of the challenge is significant.

According to the research:

- 79% of organizations acknowledge visibility gaps in their asset inventories

- 46% of financial institutions experienced a data breach in the past 24 months

- The average cost of a financial services data breach is $6.08 million, the second-highest of any industry

Despite heavy investment in cybersecurity tools, many banks still lack a complete, real-time understanding of:

- What assets are connected to their networks

- Where sensitive data resides

- Which devices are active, idle, or forgotten

These blind spots don’t just weaken security – they undermine compliance and slow responses when incidents occur.

Why Banks Struggle to Maintain Accurate Asset Inventories

1. Complex, Fragmented IT Environments

Modern banks operate across:

- Multiple hardware vendors and platforms

- On-premises infrastructure and cloud services

- Licensed software, SaaS tools, and open-source applications

- Legacy systems integrated with modern APIs

This fragmentation makes centralized oversight challenging, resulting in inconsistent data, duplicated efforts, and gaps between IT, security, and compliance teams.

2. Shadow IT Is No Longer the Exception

The research shows that 80% of workers admit to using SaaS applications without IT approval.

In financial services, shadow IT introduces serious risk:

- Unapproved tools may store customer or financial data

- Devices and applications operate outside security monitoring

- Compliance teams lack visibility into where regulated data flows

What starts as convenience quickly becomes a compliance and security liability.

3. Hidden Data-Bearing Devices

Even organizations with mature internal controls routinely overlook assets that store sensitive data.

Real-world examples include:

- Printers and copiers with embedded hard drives

- Smart displays and networking equipment with internal storage

- Decommissioned devices stored “temporarily” without tracking

In one documented case, a financial services organization with strong inventory practices still had unlisted data-bearing devices discovered during disposal, including a copier hard drive that had never been wiped.

How Unmanaged Assets Become Entry Points for Attackers

Attackers don’t need to compromise core banking systems directly if they can enter through less-protected assets.

Printers and Copiers: The Forgotten Attack Vector

Modern multifunction printers:

- Store copies of scanned, printed, and faxed documents

- Run full operating systems

- Connect directly to internal networks

Research cited in the document identified hundreds of printer models across multiple vendors affected by serious vulnerabilities, including authentication bypass flaws that allow attackers to gain administrative access.

Once compromised, these devices enable:

- Credential harvesting

- Lateral movement across the network

- Persistent access that often goes unnoticed

As one security expert warned in the research, printers are often “plug it in and forget it” devices, exactly the type attackers look for.

The Cost of Poor Visibility During an Incident

When an incident occurs, speed matters.

The research highlights that:

- Organizations with mature ITAM programs reduce incident response times by up to 50%

- Breaches that take over 200 days to identify and contain average $5.46 million in cost

- Faster containment significantly reduces operational and financial impact

Without asset visibility, response teams lose precious time:

- Identifying affected systems

- Tracing lateral movement

- Determining which assets contain sensitive data

With accurate asset intelligence, banks move from chaos to control.

Why ITAD Failures Surface During Audits and Investigations

Asset visibility challenges don’t end when devices are retired.

One of the most well-documented U.S. examples is Morgan Stanley, where improper IT asset disposal practices led to more than $161 million in cumulative fines and settlements. The failure wasn’t a sophisticated cyberattack – it was a breakdown in inventory tracking, vendor oversight, and chain of custody during hardware decommissioning.

Key failures identified included:

- Inadequate oversight of a third-party disposal vendor

- Devices sold with unencrypted data intact

- Inability to account for the majority of decommissioned assets

For banks, ITAD failures often surface during:

- Regulatory audits

- Incident investigations

- M&A integration reviews

And when they do, the consequences are severe.

Regulatory Expectations Make Visibility Non-Negotiable

U.S. financial institutions are required to maintain clear asset accountability under multiple frameworks, including:

- GLBA Safeguards Rule: explicitly requires asset inventory and secure data disposal

- PCI DSS: mandates up-to-date inventories of in-scope systems and devices

- FFIEC Guidelines: emphasize comprehensive asset identification and lifecycle management

In short, you can’t demonstrate compliance without asset visibility.

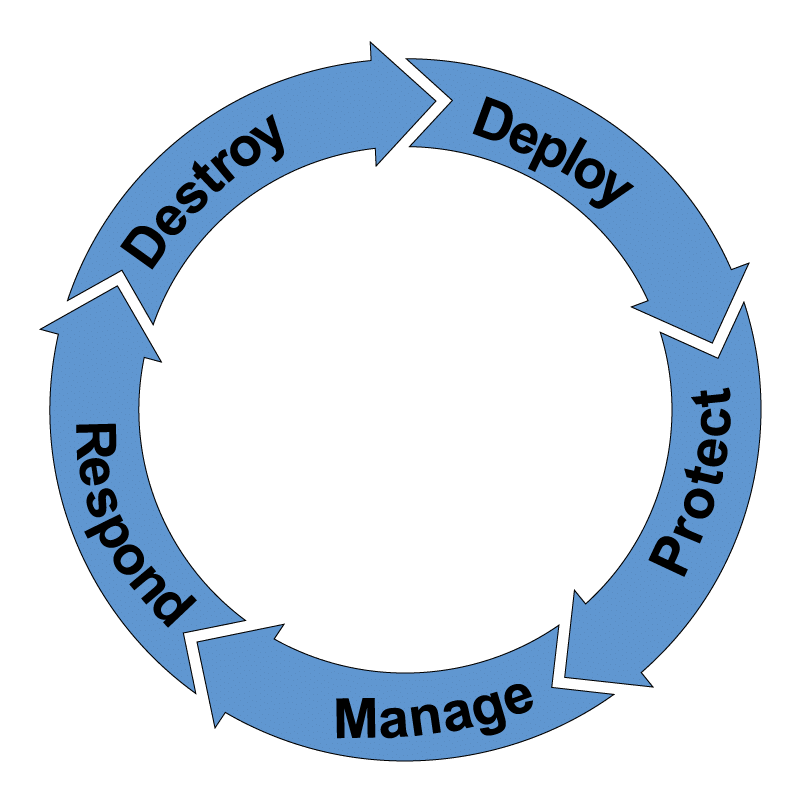

The Case for an Integrated Approach

Traditional models treat IT Asset Management, IT Asset Disposition, and Security monitoring as separate functions. This creates gaps, delays, and duplicated effort.

An integrated approach connects:

- Asset inventories to security monitoring

- End-of-life tracking to compliance reporting

- Incident response to real-time asset context

For banks, this reduces:

- Operational stress

- Audit preparation time

- Risk exposure across the asset lifecycle

The Leadership Takeaway: See What Regulators and Attackers Already Can

Banks don’t lose data only through sophisticated cyberattacks. They lose it through what they can’t see. Resilience360 provides a board-friendly, external view of your bank’s cyber exposure, asset visibility gaps, and trust risks.

In a 30-45 minute executive discussion, we help banking leaders understand what’s visible, what’s missing, and where to focus to reduce risk and strengthen resilience.