Cyber Insurance Isn’t Enough: How to Fortify Your Business Against Threats

Many CEOs, CIOs, CISOs, and IT Leaders turn to cyber insurance as a layer of protection against cyber risks. However, relying solely on insurance can create a false sense of security. As a strategic partner, Reclamere emphasizes that cyber insurance should be part of a holistic approach to cybersecurity—not a replacement for strong, proactive measures.

Many CEOs, CIOs, CISOs, and IT Leaders turn to cyber insurance as a layer of protection against cyber risks. However, relying solely on insurance can create a false sense of security. As a strategic partner, Reclamere emphasizes that cyber insurance should be part of a holistic approach to cybersecurity—not a replacement for strong, proactive measures.

Understanding the Limits of Cyber Insurance

While cyber insurance is essential, it’s not a catch-all solution. There are significant limitations that business leaders must understand:

- Business Interruption

Cyber insurance policies often cover only a fraction of the financial losses associated with a cyberattack. Although some costs may be recouped, insurance cannot compensate for the full impact on productivity, revenue, and operational disruption. Imagine a ransomware attack shutting down your network for days; the loss in business continuity could be astronomical, and insurance will only partially cover those losses. - Reputational Damage

A single cyber incident can erode years of hard-earned trust. While cyber insurance may help with incident response costs, it won’t repair damaged relationships with clients or restore your brand’s reputation. The true cost of rebuilding trust often extends far beyond any payout you might receive. - Evolving Threat Landscape

Cyber threats are not static; they evolve rapidly. Policies written today may not cover the emerging threats of tomorrow. For instance, AI-driven cyberattacks, deepfakes, or new ransomware variants might not be covered under your existing insurance policy. Having a dynamic cybersecurity strategy is the only way to adapt and respond effectively. - Social Engineering Attacks

Social engineering is one of the most common attack vectors today. Despite its prevalence, many cyber insurance policies exclude coverage for financial losses resulting from phishing scams or fraudulent transfers. It underscores the importance of having robust training and security protocols to prevent such incidents in the first place. - Insider Threats

Internal threats, whether intentional or accidental, often fall outside the purview of cyber insurance coverage. If an employee inadvertently exposes sensitive data or if a disgruntled team member deliberately compromises your systems, your claim might be denied. Therefore, building a strong insider threat program and monitoring internal activities are vital. - Nation-State Attacks

As cyber warfare continues to escalate, attacks from nation-states have become more prevalent. Unfortunately, many insurance providers classify these incidents as “acts of war,” meaning they won’t cover the resulting damage or losses. This limitation reinforces the need for proactive defenses to minimize exposure to sophisticated attackers.

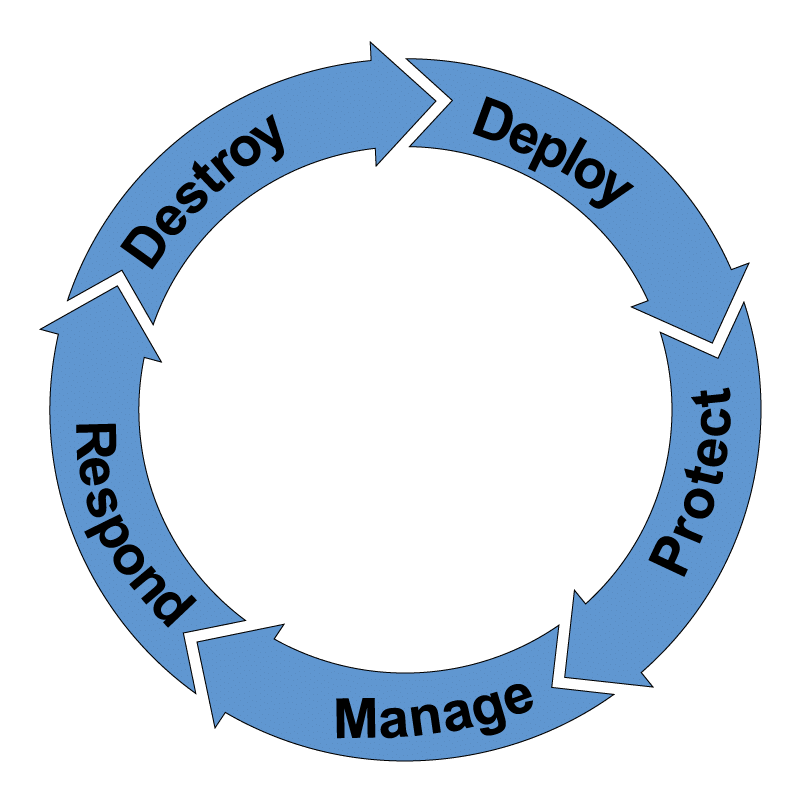

Building a Strong Cybersecurity Posture: Beyond Insurance

A comprehensive cybersecurity strategy goes far beyond just having an insurance policy. Here are six steps you can take to strengthen your organization’s cyber defenses:

- Regular Employee Training

Your workforce is your first line of defense. Investing in regular cybersecurity training, phishing simulations, and awareness programs will reduce the likelihood of human error, which accounts for a significant percentage of breaches. Employees should be empowered to recognize threats and act as vigilant gatekeepers. - Implement Multi-Factor Authentication (MFA)

Relying on passwords alone is no longer sufficient. MFA adds an additional layer of security, making it exponentially more difficult for unauthorized users to gain access, even if credentials are compromised. For CEOs and CIOs, adopting MFA across all sensitive systems can prevent costly breaches. - Regular Data Backups

Data is the lifeblood of your organization. Regularly backing up business-critical data ensures you can recover quickly from ransomware attacks or data loss incidents. Implement an automated backup strategy and test it frequently to ensure it works when needed most. - Invest in Continuous Monitoring and Threat Detection

A proactive approach to cybersecurity requires real-time visibility into your network’s activities. Continuous monitoring, using tools like Security Information and Event Management (SIEM), can help detect anomalies and stop breaches before they escalate. Reclamere offers advanced monitoring solutions to keep your business protected around the clock. - Keep Software and Security Solutions Updated

Outdated software is a prime target for cybercriminals. Regularly update your systems, applications, and security tools with the latest patches and fixes. This simple yet effective step can close vulnerabilities that attackers might exploit. - Establish a Comprehensive Incident Response Plan

Preparation is key. Develop a detailed incident response plan that outlines roles, responsibilities, and communication protocols in the event of a breach. Regularly test this plan through tabletop exercises to ensure your team is ready to act quickly and decisively when faced with a cyber crisis.

The Role of Cyber Insurance in Your Cybersecurity Strategy

While cyber insurance provides a financial safety net, it is not a substitute for strong cybersecurity measures. Instead, think of it as one piece of a larger puzzle. It offers financial support during a breach, but without the right prevention strategies, detection mechanisms, and response plans, your organization remains vulnerable.

At Reclamere, we understand the balance between insurance and proactive security. We work with CEOs, CIOs, and CISOs to develop comprehensive cybersecurity programs that protect against evolving threats while ensuring you get the most out of your cyber insurance policy. We don’t just help you react to incidents—we help you prevent them.

Building a Resilient Future for Your Business

Achieving a strong cybersecurity posture requires a multifaceted approach. Your organization’s ability to survive and thrive in today’s digital landscape depends on implementing both preventative measures and having insurance coverage as a safety net.

Ready to take the next step in strengthening your cybersecurity defenses? Reclamere is here to partner with you. Our team of experts will evaluate your current infrastructure, identify vulnerabilities, and design a tailored strategy that complements your cyber insurance policy while fortifying your defenses.

Don’t wait until it’s too late—get started with a Cyber Posture Scorecard review today and let’s build a secure and resilient future together.