Navigating Cybersecurity Insurance Policies: Why Reclamere IS Your Trusted Partner

In today’s digital landscape, cybersecurity threats are a significant concern for organizations of all sizes. Many companies turn to cybersecurity insurance policies to mitigate potential damages from cyber incidents. However, not all policies are created equal. Each approach has unique requirements, making it crucial for companies to work with a trusted partner like Reclamere. Our comprehensive services, including SOC360 for EDR assistance and VMS360 for patch management and vulnerability scanning, perfectly position organizations to navigate the complexities of cybersecurity insurance policies.

In today’s digital landscape, cybersecurity threats are a significant concern for organizations of all sizes. Many companies turn to cybersecurity insurance policies to mitigate potential damages from cyber incidents. However, not all policies are created equal. Each approach has unique requirements, making it crucial for companies to work with a trusted partner like Reclamere. Our comprehensive services, including SOC360 for EDR assistance and VMS360 for patch management and vulnerability scanning, perfectly position organizations to navigate the complexities of cybersecurity insurance policies.

Understanding the Varied Requirements

Cybersecurity insurance policies are designed to provide financial protection and support in the event of a cyber incident. However, the requirements within these policies can vary significantly. Let’s focus on three essential aspects: Multi-Factor Authentication (MFA), Endpoint Detection and Response (EDR), and Patch Management.

- Multi-Factor Authentication (MFA): MFA is a crucial security measure that adds an extra layer of protection to authenticate user identities. Many cybersecurity insurance policies now require organizations to implement MFA to reduce the risk of unauthorized access. By partnering with Reclamere, companies can leverage their expertise in implementing MFA solutions, ensuring compliance with policy requirements.

- Endpoint Detection and Response (EDR): EDR is critical in detecting and responding to advanced cyber threats. Some insurance policies mandate using EDR solutions to enhance an organization’s ability to identify and mitigate potential breaches. Reclamere’s SOC360 service provides comprehensive EDR assistance, enabling organizations to meet these policy requirements while improving their overall cybersecurity posture.

- Patch Management & Vulnerability Scanning: Effective patch management and vulnerability scanning are essential for maintaining a secure IT environment. Cyber insurance policies often require organizations to demonstrate regular patching and scanning practices to mitigate vulnerabilities. Reclamere’s VMS360 service offers robust patch management and vulnerability scanning capabilities, ensuring companies meet these policy requirements and avoid potential threats.

The Value of Partnering with Reclamere

Given the varying requirements of cybersecurity insurance policies, companies need to partner with a trusted organization.

Here’s why:

- Expert Guidance: An experienced team understands the intricacies of different cybersecurity insurance policies. They can provide invaluable guidance in selecting the most suitable policy for an organization’s specific needs, ensuring that all policy requirements are met.

- Tailored Solutions: Services like SOC360 and VMS360 offer tailored solutions to assist organizations in meeting policy requirements. SOC360 provides EDR assistance, detecting and responding to threats effectively, while VMS360 ensures robust patch management and vulnerability scanning capabilities that align with policy mandates.

- Compliance & Risk Mitigation: Partnering with Reclamere helps companies mitigate compliance risks by ensuring adherence to policy requirements. By implementing the recommended cybersecurity practices and leveraging Reclamere’s services, organizations can enhance their security maturity and minimize the likelihood of incidents.

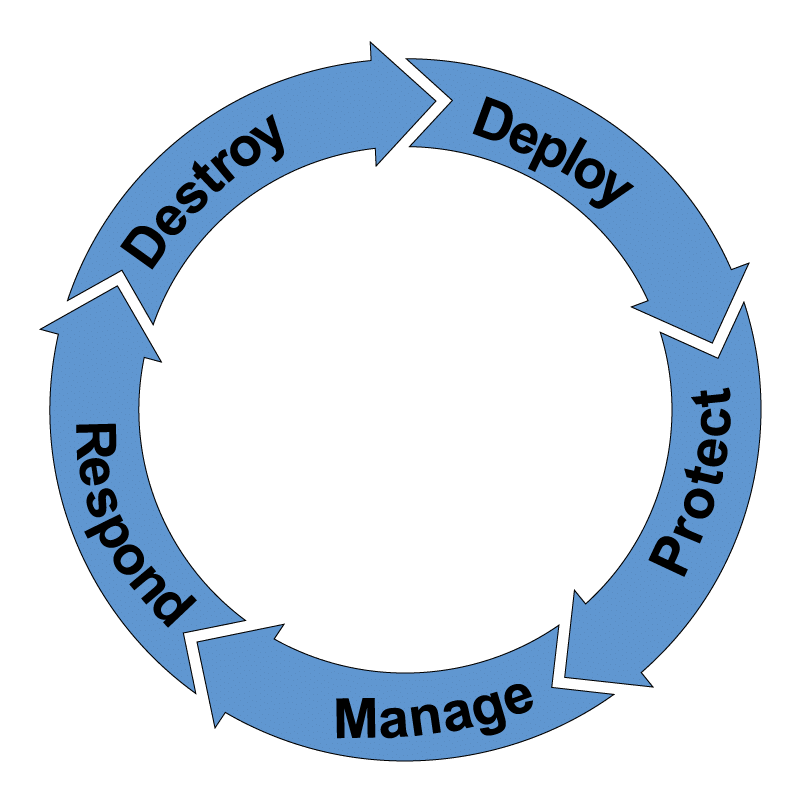

- Efficient Incident Response: Reclamere’s expertise in incident response can provide swift and effective support in the unfortunate event of a cyber incident. Their comprehensive incident response services help organizations navigate the aftermath of an incident, which goes hand in hand with working closely with insurance providers to expedite the claims process.

With the diverse requirements of cybersecurity insurance policies, organizations need a trusted partner to navigate the complexities and ensure compliance. Our tailored solutions work to meet policy mandates such as MFA, EDR, and patch management. By leveraging a partner’s expertise, organizations can select the most suitable policy, enhance their cybersecurity posture, and minimize the risks associated with cyber incidents.

Look for comprehensive services and guidance that empowers you to protect your digital assets proactively, ensuring you are well-prepared and supported in the face of evolving cyber threats. Regarding cybersecurity insurance requirements, working with a partner can be key to peace of mind and effective risk management.

For more information on our suite of cybersecurity services, check out our interactive booklet. To schedule a no-cost evaluation of your cyber liability policy or for assistance in completing a cyber liability insurance application, contact us today.