The Need for a Cyber Insurance Policy Review as Part of Cyber Risk Management

All businesses are increasingly recognizing the importance of Cyber Risk Management to safeguard their assets. One pivotal aspect of this management strategy is the thorough review and assessment of Cyber Insurance Policies, a component that often goes overlooked.

All businesses are increasingly recognizing the importance of Cyber Risk Management to safeguard their assets. One pivotal aspect of this management strategy is the thorough review and assessment of Cyber Insurance Policies, a component that often goes overlooked.

As we approach 2024, a time where cyber threats continue to grow in sophistication and frequency, it’s important for businesses to ensure their Cyber Insurance Policies are not only in place but also effectively tailored to address the diverse and dynamic challenges that regularly change the business landscape.

Preparation Through Review

For those who have yet to delve into the realm of Cyber Insurance, embarking on this journey might seem daunting. However, Reclamere can offer a mini-audit to help prepare for the acquisition or renewal of Cyber Insurance. While we cannot pre-determine estimated costs or guarantee approval, the mini-audit involves evaluating various aspects essential for insurance approval, focusing on the following categories:

Awareness & Training

Cyber Insurance providers often look for businesses that demonstrate a commitment to cybersecurity awareness and education. In-person cybersecurity training, conducted at least annually, covering topics such as email, WiFi, smartphone usage, and password policies, exhibits proactive measures in preventing cyber incidents.

Protective Measures

Insurance companies emphasize robust protective measures that mitigate risks effectively. This includes having up-to-date firmware for routers and firewalls, regularly updating operating systems, enforcing stringent password complexity, employing centralized antivirus software, implementing endpoint detection and response mechanisms, and safeguarding mobile devices.

Detection & Response Mechanisms

The ability to detect and respond promptly to cyber threats is a crucial factor. Monthly reviews of traffic logs, 24×7 monitoring via a Security Operations Center (SOC), dark web monitoring for stolen passwords, and stringent access controls exemplify a commitment to detecting and responding to potential breaches effectively.

Recovery Strategies

A significant aspect insurance providers scrutinize is a business’s recovery capabilities. This involves offsite backups, regular testing of backups, archiving emails, utilizing offsite hardware for critical systems, and the ability to run essential operations offsite in the event of a cyber incident.

Importance of Categorization

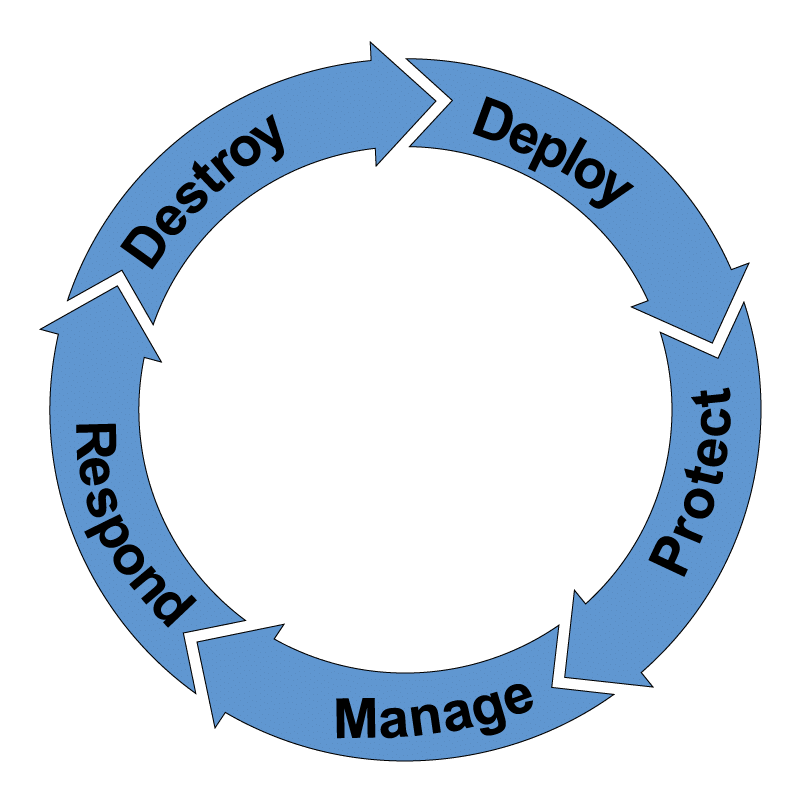

While all these elements are vital, it’s essential to categorize and prioritize them based on their impact and relevance to the business. For instance:

- Training & Awareness: Essential for preemptive risk mitigation.

- Protective Measures: Crucial for minimizing vulnerabilities.

- Detection & Response: Vital for early threat identification and containment.

- Recovery Strategies: Critical for business continuity and resilience.

The Challenge of Work-From-Home (WFH) Devices

The current landscape, especially with widespread remote work, presents challenges in implementing some security measures on personal devices used for work purposes. Insurance providers may scrutinize this aspect closely, emphasizing the need for robust security measures on WFH devices.

Takeaways

In conclusion, Cyber Insurance Policy Review stands as a pivotal element within the broader spectrum of Cyber Risk Management. The ability to comprehensively address the above categories and prioritize them effectively can significantly impact insurance approval and coverage.

Reclamere offers assistance in navigating this complex landscape, providing insights through mini-audits to aid businesses in preparing for Cyber Insurance. By focusing on enhancing cybersecurity measures and aligning them with insurance requirements, companies can not only mitigate risks effectively but also demonstrate their commitment to cybersecurity, positioning themselves favorably in a rapidly evolving digital ecosystem.

Connect with us to see how we can assist your organization!